Tax season often brings a sense of dread for both individuals and businesses, especially small business owners juggling multiple responsibilities. The pressure of navigating ever-changing tax regulations, keeping up with the latest laws, and ensuring every financial detail is accurate can quickly become overwhelming. For many, this stress is compounded by the fear of missing deadlines or making mistakes that could lead to audits or penalties. Managing tax preparation in-house often stretches already limited resources, pulling attention away from core business activities.

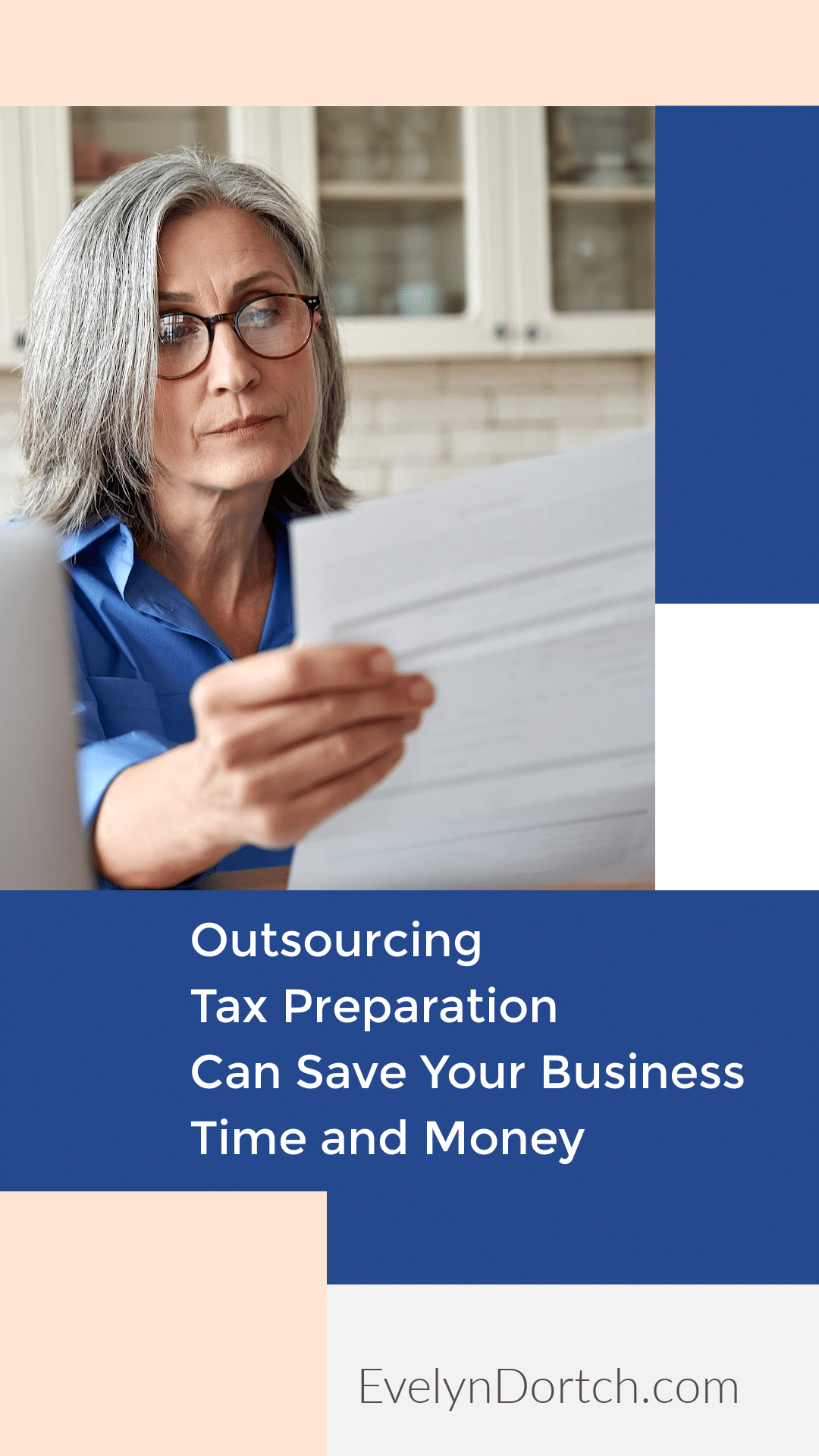

One of the most effective solutions to this growing challenge is outsourcing tax preparation to professionals. By entrusting this critical task to experts, small businesses can significantly reduce the stress that comes with tax season. Not only does outsourcing tax preparation ensure compliance with complex regulations, but it also minimizes the risk of costly errors, saving both time and money in the long run. In this blog post, we’ll explore why outsourcing tax preparation is a smart decision, how it alleviates stress, and the financial benefits of avoiding mistakes.

The Rising Challenges of Tax Preparation

Tax preparation has become increasingly complex and time-consuming, especially as tax laws continue to evolve. Keeping up with the latest regulations, deadlines, exemptions, and allowances can be overwhelming for small business owners. Falling behind on important updates not only risks missing out on potential savings but can also lead to penalties for non-compliance. For businesses, the stakes are even higher, as they must remain informed on both local and federal tax requirements.

The stress often amplifies when business owners, who may not be experts in finance or tax law, recognize the potential for costly errors. Simple mistakes, such as incorrect data entry or miscalculated deductions, can trigger audits, fines, or delayed refunds. This is where outsourcing tax preparation to professionals, whether in the United States or through accounting services in UK, becomes an appealing and practical solution. By turning to experts, businesses can ensure accuracy, compliance, and peace of mind.

5 Benefits of Outsourcing Tax Preparation

Expertise and Knowledge

When you outsource your tax preparation, you’re putting your financial documents in the hands of experts. Accounting firms and tax professionals have the training and experience to handle even the most complicated tax situations. They stay updated on the latest changes in tax laws, ensuring that all regulations are followed and that you receive the maximum benefits. This expertise significantly reduces the risk of errors.

Time-Saving Solution

Preparing taxes can take hours or even days, depending on the complexity of your situation. This time could be better spent focussing on growing your business or handling other important personal matters. By outsourcing, you free up your time, allowing professionals to manage the tax process on your behalf efficiently. This reduces stress and ensures that your taxes are completed on time.

Reduced Errors and Penalties

One of the greatest advantages of outsourcing tax preparation is reducing errors. Tax professionals can access advanced software that checks for potential mistakes and inconsistencies. Their attention to detail helps prevent simple yet costly errors that could trigger audits or penalties. Understanding tax codes also allows them to correctly apply deductions and credits, maximising your return while staying compliant with HMRC regulations.

Cost-Effective in the Long Run

At first glance, outsourcing tax preparation is an added expense. However, considering the potential savings from avoiding mistakes, penalties, and missed deductions can be a cost-effective solution. Tax professionals specialising in Corporation Tax Outsourcing can often identify tax-saving opportunities you might overlook, leading to substantial savings. In the long run, the cost of outsourcing will likely be outweighed by the benefits.

Peace of Mind

The most significant benefit of outsourcing tax preparation is peace of mind. Knowing that experts are handling your taxes reduces the anxiety associated with tax season. You can rest easy knowing everything is handled with no last-minute rushes or uncertainties. This can significantly improve your mental well-being during a stressful period.

Common Mistakes People Make When Handling Taxes Themselves

For those who choose to manage their taxes, several common mistakes can occur:

- Missing Deadlines: Not filing on time can result in hefty penalties.

- Incorrect Deductions: Many people fail to claim all the deductions they are entitled to, resulting in lost savings.

- Data Entry Errors: Simple mistakes in numbers or names can delay processing or trigger an audit.

- Misunderstanding Tax Laws: Tax codes are complex and change frequently. Without proper knowledge, it’s easy to overlook important details.

- Filing Under the Wrong Category: Businesses, in particular, can face issues if they file under the wrong tax category or need to remember to update their status.

By outsourcing, you avoid these common pitfalls, as professionals ensure every detail is correct and up-to-date.

Choosing the Right Tax Professional

Once you’ve decided that outsourcing tax preparation is the best option for your business, selecting the right tax professional is crucial. Not all accounting services are the same, and it’s important to find a firm or individual that specializes in your specific tax situation. Whether you’re a small business owner, an individual with complex financials, or a larger corporation, choosing the right expert can make a significant difference. Be sure to verify their qualifications, such as certifications or memberships in professional organizations, to ensure you’re working with someone who is well-versed in the complexities of tax preparation.

Another key consideration when outsourcing tax preparation is the firm’s reputation and experience. Take the time to read client reviews and ask for references to get a better understanding of their performance and client satisfaction. A tax professional who has worked with businesses similar to yours will have the knowledge and insight to manage your tax obligations effectively. Additionally, inquire about their tax management approach to ensure it aligns with your business needs, whether that means maximizing deductions, managing cash flow, or minimizing your tax liability.

A major advantage of outsourcing tax preparation to a professional is that many firms offer year-round support, not just during tax season. This ongoing service can help your business stay organized and financially prepared throughout the year, giving you peace of mind well before deadlines approach. With proactive planning and continuous oversight, a tax professional can help you manage your financial strategy, making outsourcing tax preparation a valuable investment in the long-term success of your business.

Outsourcing tax preparation can be one of the smartest decisions you make, whether an individual or a business owner. The process saves time and significantly reduces the risk of errors and penalties. By entrusting your tax preparation to experts, you can enjoy peace of mind, avoid costly mistakes, and even identify savings opportunities you may have missed on your own.

In a world where tax regulations constantly evolve, outsourcing provides a reliable solution to stay compliant and stress-free. So, when the next tax season rolls around, consider handing over your financial responsibilities to professionals who can help you easily navigate the complexities of tax preparation.